As an avid motorcyclist, you’ve likely experienced the thrill of cruising down the open road, the wind in your hair, and the freedom of the journey. However, along with this exhilarating experience comes the responsibility of ensuring both your safety and financial protection. Motorcycle insurance plays a crucial role in safeguarding you against unforeseen circumstances, providing peace of mind and enabling you to fully embrace the joys of riding.

I. Understanding the Importance of Motorcycle Insurance

Motorcycle insurance is not just an option; it’s a necessity for riders operating their vehicles on public roads. Most states mandate motorcycle insurance coverage to protect both the rider and others in case of accidents. This financial safeguard ensures that you are not left bearing the burden of medical expenses, property damage claims, or potential legal liabilities arising from an accident.

Beyond the legal obligation, motorcycle insurance offers a sense of security and peace of mind. Knowing that you have adequate coverage allows you to focus on the enjoyment of the ride without the constant worry of potential financial repercussions. Whether you’re an experienced rider or a novice just starting out, motorcycle insurance provides a safety net that empowers you to ride with confidence.

II. Factors Affecting Motorcycle Insurance Costs: A Rider’s Profile

The cost of motorcycle insurance is not a one-size-fits-all proposition. Several factors influence your insurance premiums, and understanding these factors can help you make informed decisions to manage your insurance costs effectively.

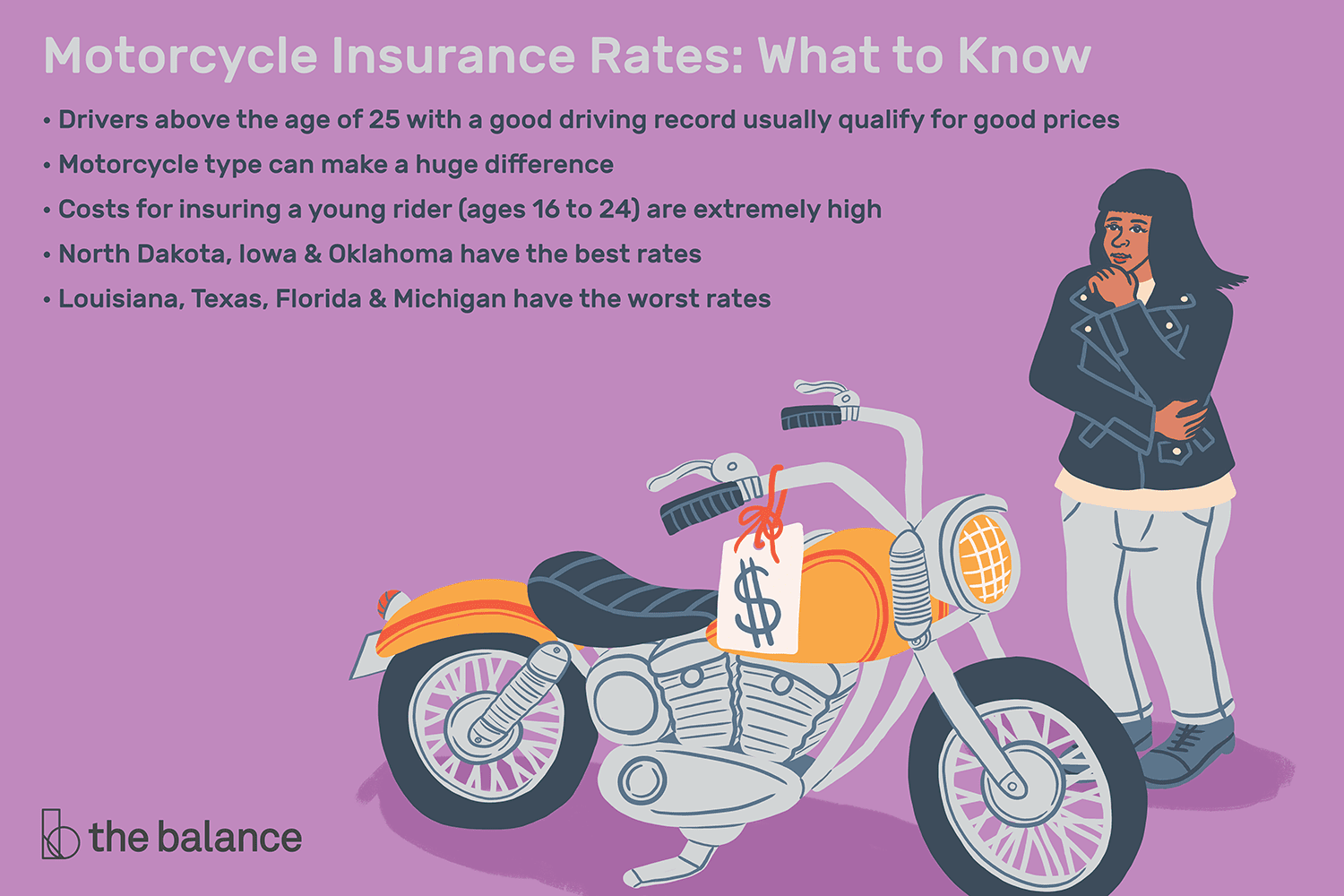

One of the primary determinants of motorcycle insurance costs is your rider profile. This includes your age, riding experience, and motorcycle type. Younger riders with less experience typically face higher premiums due to the perceived higher risk of accidents associated with this demographic. Similarly, sport bikes and high-performance motorcycles often incur higher premiums as they are considered more likely to be involved in accidents.

Your location and riding habits also play a significant role in determining insurance costs. Urban areas with high traffic density and increased risk of theft generally lead to higher premiums compared to rural areas. Additionally, your riding history and claims records are heavily considered by insurance providers. A clean riding record with no accidents or claims can significantly lower your insurance costs, while a history of accidents or claims can result in higher premiums.

III. Types of Motorcycle Insurance Coverage: Understanding Your Options

When selecting motorcycle insurance, it’s crucial to understand the different types of coverage available and tailor your policy to your specific needs. The most basic coverage, liability insurance, is mandated by law in most states. It covers bodily injury and property damage caused to others in the event of an accident you are at fault for.

While liability insurance is essential, it may not be sufficient to cover all potential costs. Collision insurance provides coverage for damage to your own motorcycle in the event of a collision with another vehicle or object. Comprehensive insurance goes a step further, protecting your motorcycle against theft, vandalism, and other non-collision-related damage.

Medical payments insurance is an optional coverage that pays for medical expenses for you and your passengers in case of an accident, regardless of who is at fault. This coverage can be particularly beneficial if you have health insurance with high deductibles or co-pays. Finally, uninsured/underinsured motorist coverage provides protection in case you are hit by a driver with no or insufficient insurance.

IV. Strategies for Reducing Motorcycle Insurance Costs: A Rider’s Guide

As a motorcycle rider, you hold the power to influence your insurance costs. By adopting proactive strategies and making informed choices, you can significantly reduce your premiums and enjoy affordable coverage.

One of the most effective ways to lower your insurance costs is to shop around and compare quotes from multiple insurance providers. Competitive rates and potential discounts can be found by comparing different options, ensuring you are getting the best value for your insurance dollar.

Consider taking a motorcycle safety course. Completion of a certified safety course may qualify you for discounts from certain insurance providers, demonstrating your commitment to safe riding practices. Maintaining a clean riding record is another key factor in keeping your premiums low. Avoid accidents, traffic violations, and claims to establish a positive reputation with insurance companies.

Secure storage for your motorcycle can also reduce your insurance costs. Storing your motorcycle in a garage or a secure area can deter theft and vandalism, which are major contributors to insurance claims. If garage storage is not feasible, consider investing in a high-quality motorcycle lock or alarm system.

Finally, increasing your deductible can lower your monthly premiums. However, it’s important to choose a deductible amount that you can comfortably afford in the event of a claim. Carefully weigh the potential savings against the out-of-pocket expense before making a decision.

V. Additional Factors Influencing Motorcycle Insurance Costs: Understanding the Market

While rider profile and coverage options play a significant role in determining insurance costs, several external factors also influence premiums. Understanding these market dynamics can help you anticipate potential changes and make informed decisions.

The financial stability and reputation of your chosen insurance company are crucial considerations. Choosing a reputable company with a strong financial standing ensures reliable coverage and fair claims processing in the event of an accident. Additionally, insurance industry trends and regulations can impact your insurance costs. Changes in accident rates, theft statistics, and legal requirements can influence how insurance companies price their policies. Finally, local factors and demographics within your area can also play a role. Crime rates, traffic patterns, and infrastructure can influence insurance premiums, with higher-risk areas typically leading to higher costs.

VI. Tips for Finding Affordable Motorcycle Insurance: A Rider’s Toolkit

Finding affordable motorcycle insurance doesn’t have to be a challenge. By utilizing a few key strategies and tools, you can secure the coverage you need at a price you can afford.

Bundling your motorcycle insurance with other policies, such as car or home insurance, can often lead to significant discounts. Many insurance providers offer multi-policy discounts, rewarding customers who consolidate their insurance needs with a single company.

Consider usage-based insurance programs, which are becoming increasingly popular for motorcycles. These programs track your riding habits through telematics technology and offer lower premiums for riders who use their motorcycles less frequently or demonstrate safe riding practices.

Take advantage of discounts offered by insurance providers. Many companies reward safe riders, offer discounts for membership in motorcycle organizations, or provide reductions for motorcycles equipped with anti-theft devices. Regularly reviewing your policy can also help you identify potential savings. As your circumstances change, such as moving to a new location or purchasing a new motorcycle with advanced safety features, update your policy to ensure accurate coverage and potentially qualify for additional discounts. Finally, seeking guidance from a qualified insurance agent can be invaluable. An experienced agent can assess your needs, compare options from multiple providers, and help you find the best motorcycle insurance coverage at the most affordable price.

Motorcycle insurance is an essential part of responsible motorcycle ownership. It provides financial protection, legal compliance, and peace of mind, allowing you to focus on the enjoyment of riding. While several factors influence the cost of motorcycle insurance, understanding these factors and adopting cost-saving strategies empower you to find affordable and appropriate coverage. By prioritizing safe riding habits, maintaining a clean record, and leveraging the tools available, you can navigate the world of motorcycle insurance with confidence and hit the road knowing you’re protected. So, buckle up, stay safe, and enjoy the ride!